Student Loans getting the best of you? Rehabilitation vs Consolidation

If you or your children have Federal Student Loans in default there are two ways to get them into a better standing. If you haven’t defaulted on the loans before they’re eligible for a rehabilitation program, if they have then their only option is a consolidation program.

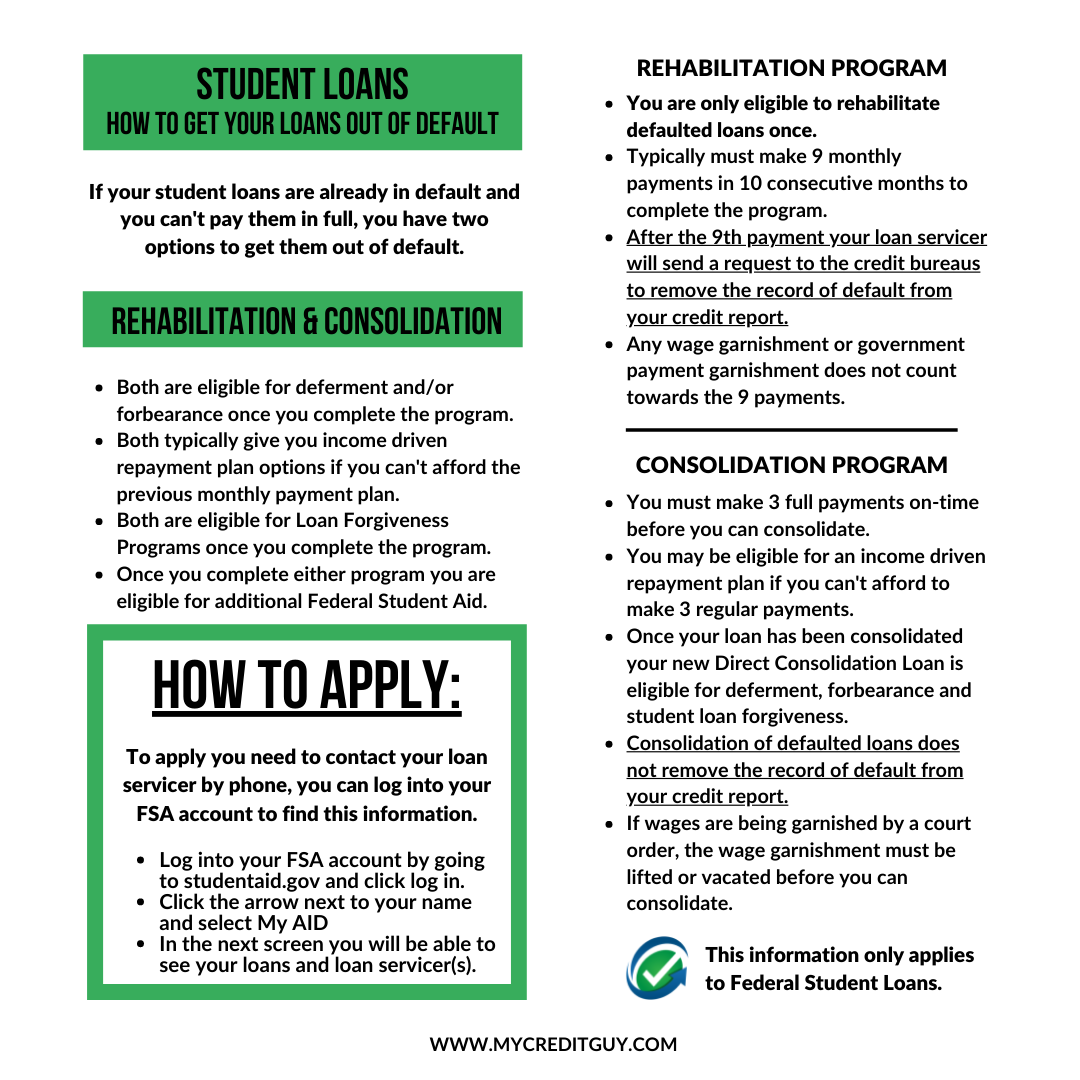

Below is a graphic that breaks down the difference between the two, why the rehabilitation program is the better option if available and how you can get the process started to get your student loans back into good standing.

This only applies to Federal loans, for Private loans you will need to reach out to the loan servicer to see what options are available to them.

One out of every ten Americans has defaulted on a student loan, life happens and it’s nothing to be ashamed about. If you’re trying to purchase a home and you have student loans in a charge-off status – you have options. Don’t let your student loans hold you back from achieving your goal of being a homeowner.

Why work with Mike?

With years of experience in the Milwaukee area, Mike understands the local market and has the expertise to make financing your home a smooth experience. Whether you’re a first-time homebuyer or looking to refinance, he’s here to tailor a plan that aligns with your financial goals.

- Interest Rate Expertise: Rates can be tricky these days, but Mike can help you lock in competitive options that work best for you.

- Clear, Simple Guidance: Mike explains your mortgage choices in straightforward terms, making the process as stress-free as possible.

- Online, Local, Personalized: Mike can meet in person or online, at your convenience. You get the flexibility to handle your loan wherever, whenever.

Ready to take the next step? Contact Mike Stoy today for a no-pressure consultation and see how easy home financing can be with the right expert by your side!