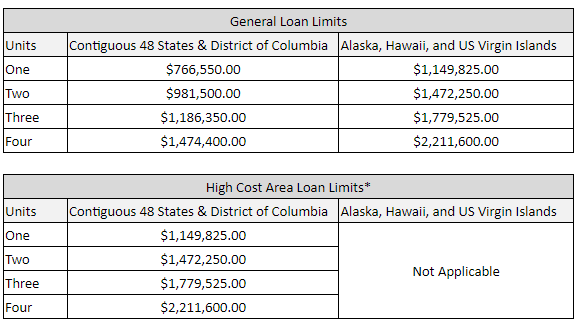

Jumbo Loan Programs exceed the maximum loan amounts established by Fannie Mae and Freddie Mac conventional loan limits. The Federal Housing Finance Agency (FHFA) has published the maximum loan limits effective for loans acquired by Fannie Mae and Freddie Mac in 2024. Both the general and high-cost area loan limits have increased. Loan limits for all counties can be located on the FHFA’s Conforming Loan Limits page.

* Several states (including Alaska and Hawaii), and the U.S. Virgin Islands do not have any high-cost areas in 2024.

The system will be updated to allow registration of loans at the higher limits as of Monday, December 4, 2023. Fannie Mae announced the new loan limits will be updated the weekend of December 2nd. Freddie Mac announced the new loan limits will be updated on December 3, 2023.

Rates on jumbo loans are typically higher than conforming loans. Jumbo Loans are typically used to buy more expensive homes and high-end custom construction homes. Typically Jumbo Loans require a higher down payment than traditional loans.

A Jumbo loan, also known as non-conforming loans, is a type of mortgage loan that exceeds the loan limits set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These loans are used to finance high-value properties that exceed the conforming loan limits established by the GSEs.

The loan limits set by Fannie Mae and Freddie Mac vary by location and are based on the median home prices in each area. In the United States, for example, the conforming loan limit for most areas in 2023 was $726,200, but it can be higher in certain high-cost areas (California is one example).

Jumbo loan Programs are typically offered by private lenders or banks and carry higher interest rates compared to conforming loans. Lenders consider them riskier because they involve larger loan amounts, which means a higher loan-to-value ratio and potentially larger monthly mortgage payments for borrowers. Mike Stoy has experience to help you figure out if a Jumbo Loan is the best option versus some type of creative way to get into a conforming loan program.

Here are some key points to understand about a jumbo loan:

- Loan amount: Jumbo loans are designed for loan amounts that exceed the conforming loan limits. The specific threshold for a loan to be considered jumbo varies depending on the region and can change over time.

- Down payment: Jumbo loans often require larger down payments compared to conforming loans. Lenders may require borrowers to put down at least 20% of the purchase price to reduce their risk exposure.

- Credit requirements: Since jumbo loans involve larger loan amounts, lenders typically have stricter credit requirements. Borrowers are expected to have excellent credit scores, typically above 700, and a strong credit history.

- Documentation: Jumbo loan applications often require more extensive documentation to verify income, assets, and other financial details. Lenders want to ensure that borrowers have the ability to handle larger loan amounts.

- Interest rates: Jumbo loans generally have higher interest rates due to the increased risk for lenders. The rates can vary depending on market conditions, the borrower's creditworthiness, and other factors.

- Additional costs: Jumbo loans may come with additional fees or charges, such as higher closing costs or private mortgage insurance (PMI) requirements, especially if the down payment is less than 20%. Most investors will not lend without at least 10% down payment. Most do not offer an option with PMI. So the rate can be higher as the risk is then built into the rate versus using private mortgage insurance.

Dare to Compare

Although the market for Jumbo Loans is thought to be with the traditional banks, you may want to think again, as we can offer more. See our our comparison chart below...

It's important to note that loan limits and requirements for jumbo loans can vary depending on the lender and the specific loan program. If you're considering a jumbo loan, it's advisable to research and compare. Contact Mike Stoy to find the best terms and rates for your financial situation.