Bank statement mortgage loans, also known as "alternative documentation loans" or "stated income loans," are a type of mortgage product that allows borrowers to qualify for a home loan by using their bank statements as proof of income instead of traditional income documentation such as tax returns, W-2s, or pay stubs. These loans are often used by self-employed individuals, freelancers, small business owners, and others who may have irregular or non-traditional income sources. Here's how bank statement mortgage loans work:

Documentation Requirements:

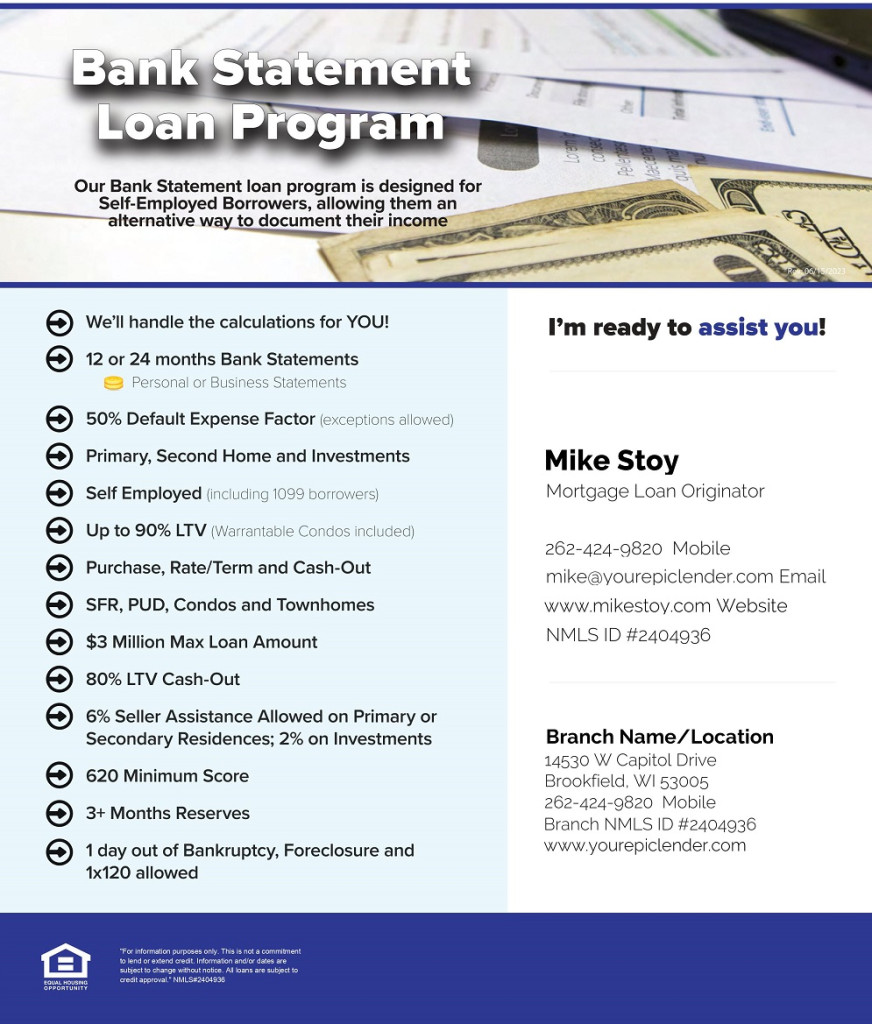

Instead of providing standard income documentation, borrowers are required to submit their personal or business bank statements, typically for the past 12 to 24 months. These statements should show regular income deposits.

Calculation of Income:

Lenders use the bank statements to calculate the borrower's average monthly income. This is typically done by adding up the total deposits over the selected time frame and dividing by the number of months.

Review of Expenses:

Lenders may also review the borrower's bank statements to assess their monthly expenses and financial habits. High expenses relative to income could affect the borrower's ability to qualify for the loan.

Credit Score and Credit History:

While bank statement loans may be more flexible in terms of income documentation, borrowers are still subject to credit checks. A good credit score and history can improve loan approval chances.

Down Payment and Loan Terms:

The down payment requirement and loan terms (interest rate, repayment period) for bank statement mortgage loans can vary among lenders. Borrowers may need to make a larger down payment or accept slightly higher interest rates compared to traditional mortgage loans.

Risk and Interest Rates:

Since bank statement loans are considered riskier for lenders due to the lack of traditional income documentation, interest rates on these loans may be higher than rates for conventional mortgages.

Prepayment Penalties:

Some bank statement loan products may have prepayment penalties, so borrowers should carefully review the terms of the loan.

Verification of Business Existence:

If the borrower is self-employed or has a business, the lender may require documentation proving the existence and legality of the business.

Investor or Portfolio Loans:

Bank statement mortgage loans are often offered by portfolio lenders or private lenders rather than traditional banks or government-backed lenders like Fannie Mae or Freddie Mac.

Limited Availability:

The availability of bank statement loans can vary by location and lender. These loans became less common after the housing market crash of 2008 but have seen a resurgence in some markets.

Risk and Considerations:

Borrowers should carefully consider the risks and benefits of bank statement loans. While they offer flexibility for those with non-traditional income, they can also come with higher costs and interest rates.

Regulation:

Regulations surrounding alternative documentation loans have tightened in recent years to prevent the abuses that contributed to the financial crisis. Borrowers should expect to provide some level of documentation and meet certain eligibility criteria.

It's important for borrowers considering bank statement mortgage loans to work closely with lenders and mortgage professionals who specialize in these types of loans. The requirements and terms can vary widely among lenders, and it's crucial to understand the terms and conditions of the loan before proceeding. Additionally, borrowers should consider seeking legal or financial advice to ensure they make informed decisions regarding their mortgage options.