Understanding Interest Rates

Interest rates on mortgages reflect the level of risk for lenders. The higher the perceived risk of repayment, the higher the interest rate charged to offset that risk. Factors Affecting Your Rate Several factors influence the interest rate you’ll receive: 1. Credit Score Your credit score is paramount. Most lenders use FICO scores, ranging from…

Read MoreApril 2024 Market Interest Rates Updates

Interest rates climbed to their highest level since November this past week amid ongoing concerns about inflation. Let’s delve into what unfolded and explore the significant news for the week ahead. Dwindling Confidence Federal Reserve Chairman Jerome Powell addressed the issue on Tuesday: “At the FOMC, we’ve stated that we require greater confidence in inflation…

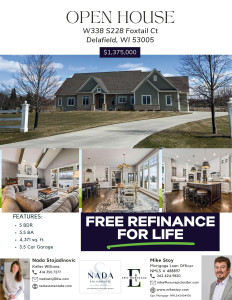

Read MoreJoin us! | Open House April 20th 1:30pm-3pm

Unlocking Rental Potential with DSCR Loans in Metro Milwaukee

Are you a landlord or investor in the Milwaukee area looking to maximize your rental income and expand your portfolio? If so, you’ll want to explore the benefits of Debt-Service Coverage Ratio (DSCR) loans, a financing option that has surged in popularity since early 2023. What are DSCR Loans? DSCR loans are a type of…

Read More4 Strategies for Crafting Your Strongest Home Offer

Considering a home purchase in today’s competitive market? With low inventory levels leading to multiple-offer scenarios, it’s crucial to strategize your approach. Here are four tips to help you make your strongest offer: 1. Collaborate with a Real Estate Agent Teaming up with a knowledgeable real estate agent is invaluable. As PODS advises, having a…

Read MoreNavigating the Rising Tide of Consumer Debt: A Guide to Consolidation

In recent years, the United States has found itself swimming in an ocean of consumer debt, reaching unprecedented levels. With the added pressure of increasing credit card rates, many individuals and families are struggling to keep their heads above water financially. This burden is felt across the nation, including right here in Wisconsin. As a…

Read MoreUnderstanding How Recent Fed Actions Affect the Housing Market

In the world of mortgages and housing, it’s crucial to stay informed about how decisions made by the Federal Reserve, or the Fed, can impact interest rates and ultimately affect homeowners and homebuyers. Let’s break down the recent Fed announcement and what it means for the housing market, with insights from Mike Stoy, an experienced…

Read MoreFannie Mae Introduces Temporary Enhancement to HomeReady Program for low-income Homebuyers

Exciting news for first-time homebuyers and repeat buyers! Fannie Mae is pleased to announce a temporary enhancement to its HomeReady® program, aimed at supporting homeownership opportunities for creditworthy, very low-income borrowers. This enhancement features a $2,500 loan-level price adjustment credit designed to assist very low-income purchase borrowers with their down payment and closing costs. HomeReady…

Read MoreUnlock Affordable Homeownership with UWM’s Conventional 1% Down Loan

Exciting news for potential homebuyers and real estate professionals! Epic Mortgage is introducing a loan product, Conventional 1% Down. This unique offering allows income-qualified borrowers to contribute just 1% towards the down payment, with the lender contributing an additional 2%, up to $4,000, making it a total of 3% down. This initiative not only makes…

Read MoreRep. John Rose Introduces Legislation to Shield Homebuyers from Abusive Mortgage Leads

In a move to protect consumers from intrusive practices in the mortgage industry, U.S. Representative John Rose (TN-06) has introduced the “Protecting Consumers from Abusive Mortgage Leads Act.” This legislation, proposed on June 16, 2023, aims to ban trigger leads, except in specific and limited circumstances. Trigger leads are generated when a consumer applies for…

Read More