Length of History

Credit Card Do’s and Dont’s

Utilization Matters When it comes to credit cards it’s all a game, borrower’s utilization too high? A strategy needs to be created to get the overall utilization under 30%. Borrower’s cards at $0? We need to look at the date of last active to see when’s the last time they got points for the cards,…

Read MoreThe Impact of rental debt impacting Americans

An article from the Consumer Financial Protection Bureau (CFPB) sheds light on the challenges around rental debt collection that impact millions of renters nationwide. With over 4.5 million households behind on rent, rental debt has become a major barrier to homeownership for many. From the article there are two key findings from approx. 1,700 complaints…

Read MoreStudent Loans getting the best of you? Rehabilitation vs Consolidation

If you or your children have Federal Student Loans in default there are two ways to get them into a better standing. If you haven’t defaulted on the loans before they’re eligible for a rehabilitation program, if they have then their only option is a consolidation program. Below is a graphic that breaks down the…

Read MoreAre You Thinking of Selling Your Home? Here are some Common Mistakes You May Want to Avoid!

With higher mortgage rates slowing buyer activity and more homes hitting the market, it’s crucial to be diligent in your selling process. Sellers benefit a great deal by using an agent to help walk you through. Agents help you stay informed and flexible while helping you navigate a smoother path to a successful closing! Here’s…

Read MoreThe Fed’s Dilemma: Interest Rates and Economic Signals

As interest rates dipped this past week, nearing levels last recorded in March, the focus intensifies on the Federal Reserve’s stance and the path forward. Will there be Cuts? During the recent Federal Reserve meeting, Chair Powell surprised many by suggesting no further rate cuts in 2024, a sharp reduction from earlier predictions. This cautious…

Read MoreUnderstanding Interest Rates

Interest rates on mortgages reflect the level of risk for lenders. The higher the perceived risk of repayment, the higher the interest rate charged to offset that risk. Factors Affecting Your Rate Several factors influence the interest rate you’ll receive: 1. Credit Score Your credit score is paramount. Most lenders use FICO scores, ranging from…

Read MoreApril 2024 Market Interest Rates Updates

Interest rates climbed to their highest level since November this past week amid ongoing concerns about inflation. Let’s delve into what unfolded and explore the significant news for the week ahead. Dwindling Confidence Federal Reserve Chairman Jerome Powell addressed the issue on Tuesday: “At the FOMC, we’ve stated that we require greater confidence in inflation…

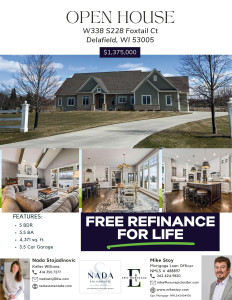

Read MoreJoin us! | Open House April 20th 1:30pm-3pm

Unlocking Rental Potential with DSCR Loans in Metro Milwaukee

Are you a landlord or investor in the Milwaukee area looking to maximize your rental income and expand your portfolio? If so, you’ll want to explore the benefits of Debt-Service Coverage Ratio (DSCR) loans, a financing option that has surged in popularity since early 2023. What are DSCR Loans? DSCR loans are a type of…

Read More